Guest

Guest

Sep 29, 2025

9:54 AM

|

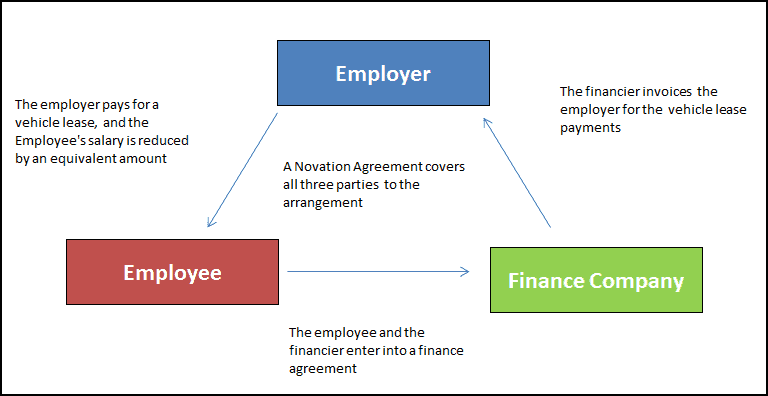

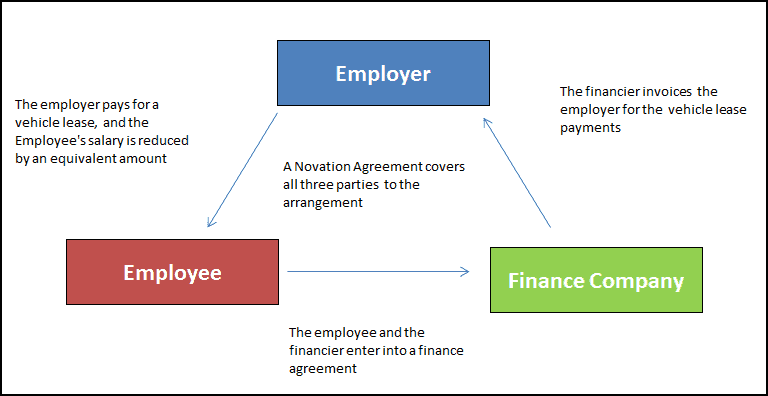

You know by now that you can get tax deductions for the personal use of a business car. But, what about if you're leasing a car Novated Leasing Calculator.

Let's see how the HMRC treats car leasing when it comes to tax relief.If your company is leasing a vehicle, you don't own it. That means that you can claim your monthly lease payments as a business expense. Nevertheless, for cars with CO2 emissions above 130g/km, there's a flat-rate disallowance of 15 percent of relevant payments. In other words, 15 percent of the expense is not allowable for tax purposes.Of course, your running costs of the car include insurance and tax, and these are deductible expenses under the Corporation Tax.

However you buy the car, it's seen as a taxable Benefit in Kind by HMRC to you as an individual. HMRC calculates this as a percentage of the car's market list price based around CO2 emissions.

The list price is the price of the car when new, not the price you paid, plus any added extras. Be aware that some dealers undercut the RRP.

There's also another additional taxable Benefit in Kind if your limited company pays for your private fuel costs. You can calculate the taxable car-fuel benefit for 2017/18 by applying the CO2-based car-benefit percentage to the current car-fuel benefit charge multiplier of £22,600.Note that if you pay for all your private fuel, including home to work, you won't get the car-fuel benefit. Otherwise, the full benefit will be due.

Here's

|